can u go to jail for not filing taxes

Incarcerated people like anyone else have to file a tax return if they have enough income. Criminal charges can only be filed if you engage in tax evasion when you break the law to avoid paying taxes including hiding income falsifying documents or failing to file a tax return.

Can You Go To Jail In Canada For Not Paying Income Taxes Quora

Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen.

. Beware this can happen to you. See if you Qualify for IRS Fresh Start Request Online. In total you could end up paying up to 25 of the overall amount you owe.

The actors federal tax debt was estimated to be around 12 million. The short answer is maybe. To better understand these distinctions take a closer look at when you risk jail time for failing to pay your taxes.

Ad TurboTax Makes It Easy To Get Your Taxes Done Right. E-File Free Directly to the IRS. There are three main civil penalties you might face if you fail an IRS audit.

A tax debt of 10000 will then incur a monthly interest of 500. A misdemeanor is considered a lesser criminal offense than a felony. However if you do not file and pay the failure to file the amount is subtracted from the failure to pay the amount.

The United States doesnt just throw people into jail because they cant afford to pay their taxes. This penalty applies if you intentionally disregard IRS rules and regulations when filing your taxes. Further if you are caught helping someone evade paying taxes you can also be arrested and charged with this crime.

As reported by the Department Of Justice in a press release from 2009 through 2016 Daryl Brown received taxable income but did not file tax. These penalties amount to 5 of a taxpayers delinquent debt each month it remains unsettled. If youve committed tax evasion or helped someone else commit tax evasion you should expect to end up in jail.

The short answer is maybe it depends on why youre not paying your taxes. The IRS imposes a 5-year prison sentence on anyone who files a fraudulent tax return and a 3-to-5-year prison sentence on those who help others do so. Failure to report specific information could cost up to 520 per return.

Ad Owe back tax 10K-200K. Owe IRS 10K-110K Back Taxes Check Eligibility. Negligent reporting could cost you up to 20 of the taxes you underestimated.

If you failed to file your taxes in a timely manner then you could owe up to 5 for each month you didnt file. In these cases you can expect a minimum penalty of 20 of the unpaid tax and in some cases as much as 75. Whether a person would actually go to jail for not paying their taxes depends upon all the details of their individual tax circumstances.

Again while a misdemeanor is not as. Most incarcerated people have in-prison jobs that pay a very small amount of and sometimes no money. To avoid late payment penalties you can simply.

The typical sentence for helping someone commit tax evasion is three to five years. E-file directly to the IRS. To avoid having to pay exorbitant penalties and interest rates on top of your owed taxes it is best.

No Tax Knowledge Needed. As far as serving jail time for failing to file yearly tax returns that would be a rare occurrence. For each month the IRS places a 5 of the unpaid taxes penalty for returning your taxes late maxing at 25.

However you can face jail time if you commit tax evasion or fraud. Sometimes people make errors on their tax returns or are negligent in filing. If you cannot afford to pay your taxes the IRS will not send you to jail.

If you owe more taxes than what you can pay there are a much better options than not. The IRS will charge you 05 every month you fail to pay up to 25. Actor Wesley Snipes also did time for failing to pay his taxes.

May 4 2022 Tax Compliance. The short answer to the question of whether you can go to jail for not paying taxes is yes. But the one thing thats important to understand is that you cannot go to jail because you dont have enough money to pay your taxes.

Thus individuals who simply neglect to file any tax returns may be required to pay fines of up to 100000 and will have to pay off all of their overdue taxes. Ad Federal Guaranteed Free. If youre having trouble with the IRS contact.

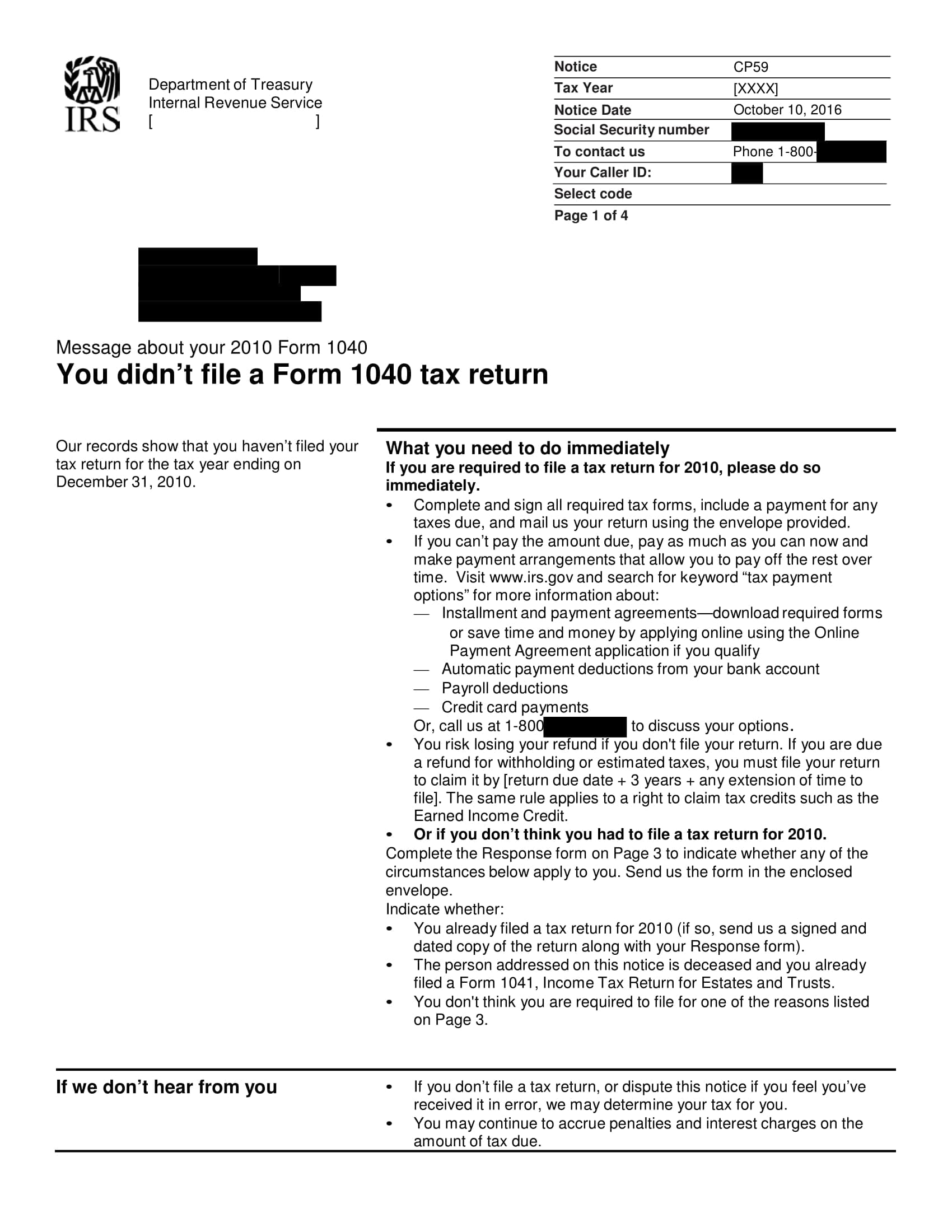

However you will not go to jail for not paying your taxes. This penalty will stay in place until the entire amount of tax debt has been paid. A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve 57 months in jail.

The best way to avoid interest and. Snipes allegedly hid income in offshore accounts and did not file federal income tax returns for several years. Most facilities pay you by putting credit in your commissary account.

However you cant go to jail for not having enough money to pay your taxes. How can I avoid interest and penalties on my unpaid taxes. Yes he was sent to prison for tax evasion not for bootlegging prostitution or murder.

In addition an individual may also face jail time for not filing taxes. However you can face jail time if you commit tax evasion tax fraud or do. The IRS has three to six years to bring criminal charges against you once your.

You can go to jail for not filing your taxes. It is true that you can go to jail for not paying your taxes just as you can for filing a fraudulent tax return. Ohio tax laws Chapter 574715 of the revised code are comprehensive with legal language and penalties to cover practically any occurrence.

However it is probably best not to rule out the possibility of imprisonment altogether just to be safe. The tax attorneys at The W Tax Group can help you navigate the tax code. File your federal taxes 100 free.

Capture Your W-2 In A Snap And File Your Tax Returns With Ease. It depends on the situation. Even if the taxes do not belong to you you still could face jail time for assisting someone carry out this federal offense.

You can go to jail for lying on your tax return.

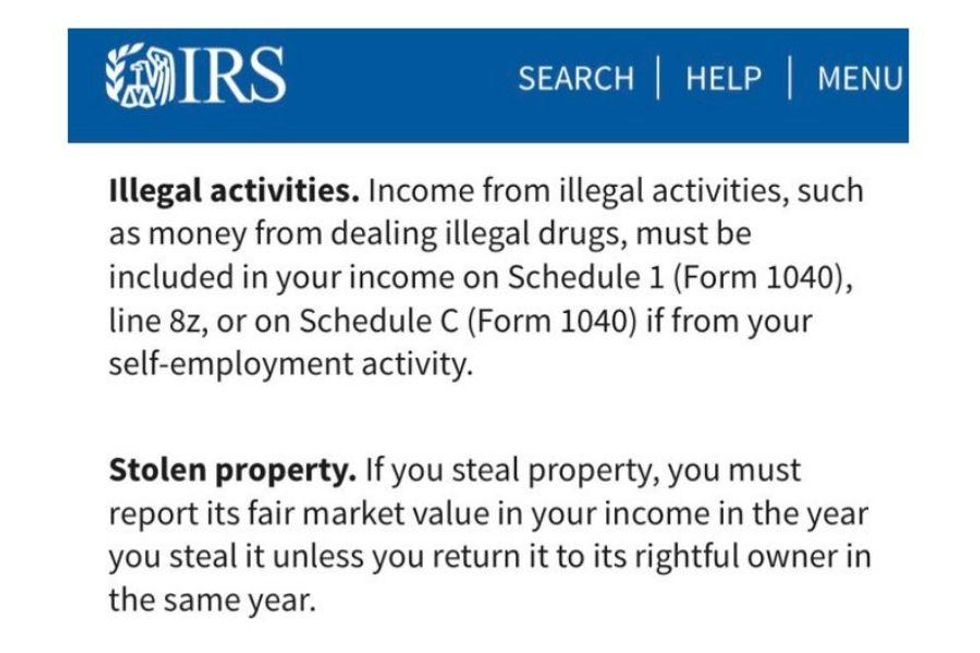

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

Non Filing Of Itr Returns Can Land You In Jail Know Penalties And Other Implications

What Happens To You If You Don T File Taxes

Lying On Taxes It S Always A Bad Idea Credit Com

Forget To File Your Nj Taxes Here S What You Should Do Now

What Happens If You File Taxes Late

Picture Memes Pmz2bpld6 Ifunny

Understanding Tax Fraud Types Penalties And Real Life Examples

What Happens If You File Taxes Late

20 Things To Know About U S Taxes For Expats H R Block

Forget To File Your Nj Taxes Here S What You Should Do Now

What Is The Penalty For Failure To File Taxes Nerdwallet

The Penalties For Not Paying Tax On Time Mint

What Happens If You File Taxes Late

Can I Go To Jail For Unfiled Taxes

Can You Go To Jail For Not Filing Taxes R Personalfinancecanada

Itr 2021 22 These High Value Transactions Must Be Declared In Your Return Business Standard News

What To Do If You Did Not File Taxes How To Avoid Major Penalties